All it takes is a few clicks.

All About Workers’ Compensation Coverage

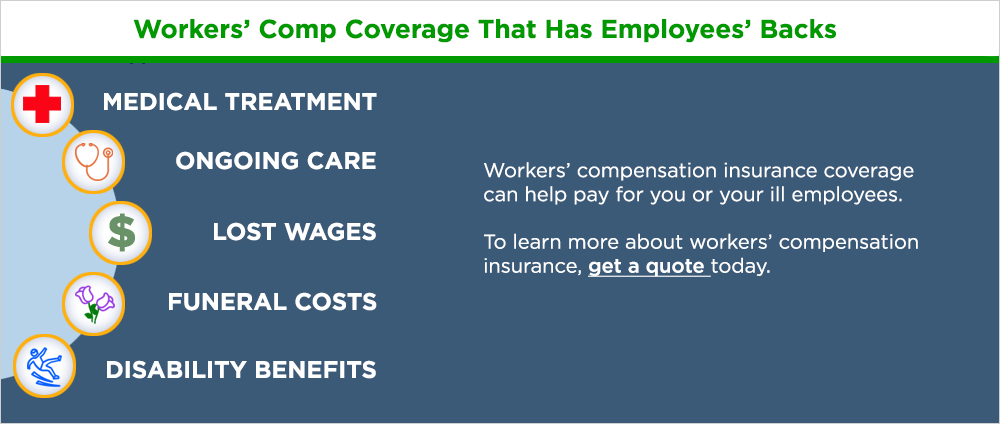

What does workers’ comp cover? Workers’ compensation insurance coverage, also known as workman’s comp, provides benefits to employees who get injured or sick from a work-related cause. This includes covering costs of medical treatment, ongoing care, lost wages, disability benefits and death benefits, like funeral costs.

What does workers’ comp cover? Workers’ compensation insurance coverage, also known as workman’s comp, provides benefits to employees who get injured or sick from a work-related cause. This includes covering costs of medical treatment, ongoing care, lost wages, disability benefits and death benefits, like funeral costs.

As a business owner, workers’ comp reduces your liability for work-related injuries and illnesses. Without coverage, your employees can sue you for a work-related injury or illness to help pay for their medical costs or lost wages.

Most states require businesses with employees to carry workers’ compensation insurance. However, each state has different rules, so the state or states where you do business will determine your workers’ comp insurance requirements. To learn more about workers’ compensation insurance, get a quote today. With over 200 years of experience, we’re an insurance carrier that’s helped countless small business owners get the coverage they need.

Costs Covered by Workers’ Comp

If your employee is injured on the job or suffers a work-related illness, workers’ compensation benefits can help cover their:

- Medical treatment

- Ongoing care

- Lost wages

- Funeral costs

- Disability benefits

These workers’ comp benefits aren’t available if your employee gets hurt or sick outside of work. Benefits may also not be available for intoxicated employees that get into an accident or employees that intentionally hurt themselves.

Medical Treatment

Workers’ comp insurance provides coverage to help your employee pay for medical expenses related to a work-related injury or illness. This can include emergency room visits, necessary surgeries, and prescriptions. For example, if one of your electricians cuts their hand at a customer’s home, workers’ compensation insurance can help cover their hospital visit.

Ongoing Care

Some work-related injuries or illnesses can be so severe that they need more than one treatment. For example, if your warehouse employee hurts their back while lifting heavy boxes, workers’ comp insurance can help cover their ongoing care costs, like physical therapy.

Lost Wages

Workers’ comp helps replace some of your employee’s lost income if they need time off to recover from a work-related injury or illness. So, if your restaurant chef spills a pot of boiling water on her arm and can’t work for two weeks, workers’ compensation coverage can help replace some of her lost wages.

Funeral Costs

In the unfortunate event that your employee loses their life from a work-related accident, workers’ compensation coverage can help pay their funeral costs and provide death benefits to your employee’s beneficiaries.

Disability Benefits

Some work injuries may be severe enough to temporarily or permanently disable your employee. Workers’ compensation coverage can give your disabled employees benefits to help pay their medical bills and replace some of their lost wages.

For example, your foreman loses the use of one of his legs and is partially disabled because of a work-related accident. He’s unable to return to work and needs continued medical and financial support. Workers’ comp can help cover his treatment costs and supplement some of his missed wages through disability benefits.

What Scenarios Qualify an Employee for Workers’ Comp Coverage?

Workers’ compensation insurance helps cover work-related injuries or illnesses. It can help cover:

- Work-related injuries

- Work-related illnesses

- Repetitive stress injuries

Work-Related Injuries

Workers' compensation insurance can help cover injuries that occur on the job. For instance, if you employee trips and breaks their ankle at your business, workers’ compensation can help pay for the hospital bills. It can also help cover their physical therapy costs.

Work-related Illnesses

Sometimes, working conditions can expose your employees to harmful chemicals or allergens that lead to illness. If your employee gets sick due to a work-related incident or condition, workers’ comp insurance can help cover their costs for necessary treatment and ongoing care.

Repetitive Stress Injuries

Not all work-related injuries are the result of a single traumatic incident. Repetitive injuries, like carpal tunnel syndrome, can take months or years to develop. If your receptionist develops carpal tunnel syndrome after years of typing with poor ergonomics, workers’ comp can help cover treatment costs and ongoing care bills.

Who Is Covered by Workman’s Comp Coverage?

Understanding the requirements of workers’ comp for employers is important as a business owner. Requirements vary from state to state. Some states have laws about workers’ comp for contracts, temps and interns.

Understanding the requirements of workers’ comp for employers is important as a business owner. Requirements vary from state to state. Some states have laws about workers’ comp for contracts, temps and interns.

Several factors, like specific roles and the size of your business, determine which employees need workers’ compensation coverage. That’s why it’s important you know what your state requires for workers’ comp.

Some states don’t require workers’ compensation coverage for:

- Farmhands

- Self-employed and independent contractors

- Insurance agents

- Family members under a certain age

- Casual workers

- Business owners and partners

- Real estate agents

Federal government employees are not covered by state-regulated workers’ compensation insurance. Instead, they’re covered by federal workers’ comp. These exceptions don’t apply everywhere in the U.S., so you need to understand your state’s workers’ compensation laws.

Some states have a minimum number of employees to determine if a business needs workers’ compensation insurance. These states are:

- Alabama

- Arkansas

- Florida

- Georgia

- Mississippi

- Missouri

- New Mexico

- North Carolina

- Rhode Island

- South Carolina

- Virginia

- Wisconsin

What Does Workers’ Compensation Coverage Cost?

The cost of workers’ compensation insurance varies depending on factors like your:

- Payroll

- Industry

- Claims history

- Type of work

State laws vary around workers’ compensation requirements. However, if you have employees, you’ll likely need this coverage. To find out how much workers’ compensation will cost you, you can get a quote. We have over 200 years of experience helping small businesses get the coverages they need.

How To Select the Right Workers’ Compensation Coverage for Your Business

The Hartford is backed by over 200 years of experience in helping small business owners protect themselves from unexpected risks. With us, you’ll gain access to our claims specialists, who consistently receive top scores for satisfaction.* And, we offer flexible billing solutions, like Auto Pay and Payroll Billing, making it easy for customers to manage their policy. Get a quote today and learn more about workers’ comp coverage.

Last Updated: December 20, 2024

This article provides general information, and should not be construed as specific legal, HR, financial, insurance, tax or accounting advice. As with all matters of a legal or human resources nature, you should consult with your own legal counsel and human resources professionals. The Hartford shall not be liable for any direct, indirect, special, consequential, incidental, punitive or exemplary damages in connection with the use by you or anyone of the information provided herein.

Additional disclosures below.